Armstrong-Joshua

Well-Known Member

Hello,

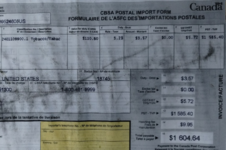

Just found out today that I cannot buy unmanufactured tobacco from Whole Leaf tobacco in Canada without a 650% pst tax! My order was $60US and CBSA wanted to charge me $752.23 PST tax!

Apparently there’s been a new law in Canada this year which allows them to charge all tobacco products unmanufactured or manufactured this ridiculous figure.

Anyone with news about this please share.

Josh

Just found out today that I cannot buy unmanufactured tobacco from Whole Leaf tobacco in Canada without a 650% pst tax! My order was $60US and CBSA wanted to charge me $752.23 PST tax!

Apparently there’s been a new law in Canada this year which allows them to charge all tobacco products unmanufactured or manufactured this ridiculous figure.

Anyone with news about this please share.

Josh